Penn Entertainment first-quarter revenue has been a topic of mixed reviews following the company’s recent report which stated earnings of $1.4 billion. This figure fell short of Wall Street’s expectations, which had projected $1.7 billion, largely due to adverse winter weather and disappointing sports betting outcomes. Nevertheless, Penn highlighted significant growth within its digital segment, driven by the expanding reach of ESPN BET and its online casino operations. The adjusted EBITDAR of $457 million indicates an improvement in operational efficiency, while the net loss of $0.25 per share was more favorable than analyst projections. With strategies in place to enhance its sports betting market share and boost digital casino revenue, Penn Entertainment is poised for recovery in the interactive gaming landscape.

In the latest financial review, Penn Entertainment has reported its Q1 earnings, revealing a revenue of $1.4 billion amid challenging conditions. The disappointing results were impacted by adverse winter weather and sports betting market fluctuations. Despite these setbacks, growth within the digital space, particularly with ESPN BET, offers a glimmer of hope. The company’s focus on enhancing interactive gaming results and capitalizing on sports betting trends indicates a strategic shift towards improving future performance. As Penn navigates these challenges, it is essential to recognize the broader implications for its market position and profitability.

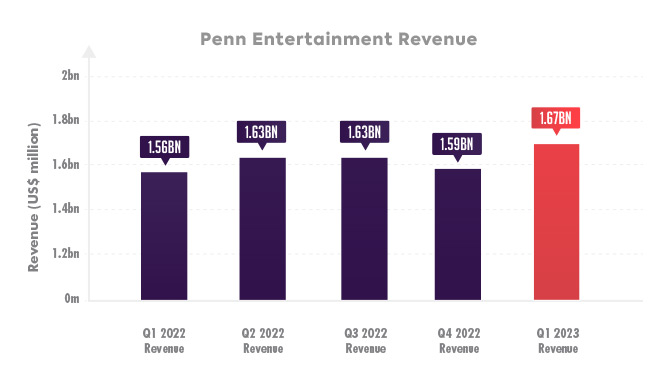

Penn Entertainment First-Quarter Revenue Underperformance

In its recent financial disclosures, Penn Entertainment reported first-quarter revenue of $1.4 billion, significantly missing Wall Street’s expectations of $1.7 billion. This shortfall can be attributed to several factors, including adverse weather conditions that impacted performance early in the year. Additionally, disappointing outcomes in the sports betting sector have compounded these revenue challenges. The situation underlines the volatility that can affect gaming revenues, showcasing how external factors like winter storms can play a pivotal role in financial outcomes.

Despite these challenges, Penn did report an adjusted EBITDAR of $457 million, and although the company recorded a net loss of $0.25 per share, this was an improvement compared to analysts’ predictions. The adjusted figures, while still below expectations, indicate that Penn Entertainment is managing to navigate some of the market hurdles better than it did a year prior, when losses were more pronounced. Thus, while first-quarter revenue was disappointing, the adjustments seen are a glimmer of hope for revenue stabilization.

The Growth of ESPN BET and Its Impact on Digital Revenue

ESPN BET, currently holding a 2.7% market share, has emerged as a crucial growth factor for Penn’s digital casino operations. Despite ranking sixth nationally, the platform showcases a promising trajectory as it continues to integrate unique offerings like fantasy-integrated prop betting, which differentiates it from competitors. The launch of features designed to enhance user experience and engagement underscores the strategic direction Penn is heading, aimed at capturing a larger slice of the sports betting market.

Moreover, the initial success of the ESPN BET brand aligns with Penn Entertainment’s long-term ambition of dominating the sports betting market, aiming for a 20% market share by 2027. With strategic investments in technology and a robust marketing approach, Penn is setting the stage for accelerated growth in its interactive gaming business. The addition of the Mint Club rewards program exemplifies how the company is enhancing customer loyalty, as data suggests that participants engage more frequently and with higher betting volumes, laying a solid foundation for sustained revenue growth.

Interactive Gaming Results: A Silver Lining Amidst Challenges

While Penn Entertainment’s overall performance faced hurdles, the interactive segment reported revenues of $290.1 million, including a significant portion attributed to its online casino and sports betting platforms. This area has shown resilience, with a year-over-year improvement indicating that Penn’s digital strategy is gradually yielding positive results despite external pressures. The adjusted EBITDA loss of $89 million signals that while the company is still in a phase of investment and expansion, it has managed to outperform prior benchmarks considerably.

The growth observed in the interactive gaming sector can largely be attributed to Penn’s established brand presence and the advancements in its technology stack. As the digital gaming landscape evolves, leveraging well-known intellectual property and engaging user experiences are critical to attracting new customers. This segment’s development is crucial for Penn, especially given the competitive environment within digital casinos, where innovation can determine market share and profitability moving forward.

Strategic Plans for Enhancing Sports Betting Market Share

With an eye on expansion, Penn Entertainment’s management remains focused on strategies that will enhance its presence in the sports betting realm. CEO Jay Snowden has consistently reiterated the company’s goal of capturing a 20% market share by 2027. Penn’s current initiatives, including the integration of its offerings with ESPN’s streaming services, represent a forward-thinking approach to capitalize on emerging consumer trends in digital betting.

The ongoing developments surrounding partnerships and technology investments indicate that Penn is prepared to adapt to the changing landscape of sports wagering. By positioning itself to leverage the popular ESPN brand, Penn aims to build a more formidable platform that can attract both casual and serious bettors alike. This strategic intent reinforces Penn’s commitment to not just survive but to thrive within the competitive sports betting industry.

Looking Ahead: Projections and Future Growth for Penn Entertainment

As Penn Entertainment eyes the future, the company has projected its second-quarter digital revenue to range between $280 million and $320 million, signaling optimism despite recent challenges. The projected adjusted EBITDA loss ranging from $50 million to $70 million suggests that while growth is anticipated, the road to profitability within the interactive segment will require vigilance and ongoing innovation. Reaching digital segment profitability by the fourth quarter remains a key target for the management team.

Investors and analysts alike are keenly observing these projections, as they reflect Penn’s strategic planning and capacity for execution in a competitive market. Leadership’s confidence in their ability to meet performance targets also highlights the evolving focus on profitability criteria, particularly with regards to their partnership with ESPN. If successful, Penn’s approach could solidify its standing not just as a market participant but as a leader within the interactive gaming industry.

ESPN Integration: An Accelerant for Growth

Looking at the upcoming integration of ESPN’s direct-to-consumer streaming platform, Penn Entertainment sees potential for significant growth. This collaborative effort could lead to enhanced visibility for the ESPN BET platform and provide a seamless experience for users looking to engage in sports betting. Penn’s CTO Aaron LaBerge has highlighted this integration as a key ‘accelerant,’ suggesting that streaming capabilities will not only enhance user engagement but also broaden the customer base significantly.

As the company prepares for this new phase, the expectation is that combining the entertainment value of live sports with betting opportunities will create a compelling offering that attracts a wider audience. By investing in technology and building strong brand partnerships, Penn is positioning itself to capitalize on the vast potential within the digital landscape, reflecting a strategic philosophy that embraces innovation to drive future revenue growth.

Navigating Shareholder Tensions Amidst Financial Changes

Internal dynamics at Penn Entertainment have become increasingly complex due to shareholder disagreements, notably with hedge fund HG Vora Capital. The recent lawsuit concerning board composition has sparked debate on corporate governance within the company. As Penn seeks to balance robust shareholder engagement with strategic corporate actions, understanding these tensions becomes essential for maintaining focused growth.

Despite these challenges, Penn is committed to ensuring transparency and aligning with shareholder interests. The company’s ongoing share repurchase program, amounting to $35 million to date, is one way management is directly addressing shareholder value concerns. This commitment to managing the company’s financial strategy amidst external pressures and internal disagreements sets a stage for renewed confidence in the firm’s direction.

The Future of Digital Casino Revenue for Penn Entertainment

As Penn Entertainment reflects on its first-quarter performance, the outlook for digital casino revenue appears cautiously optimistic. The reported increase in interactive gaming revenue signals that while growth may be slow due to external factors, there is a substantial opportunity for expansion in the online gaming sector. Given the market’s evolution, emphasizing technology and partnership strategies will be vital to capturing new customers in a competitive landscape.

Moving forward, the company is likely to continue innovating within its digital casino offerings, responding to consumer preferences, and leveraging data analytics to enhance user experiences. The goal will be to not only drive revenue growth but also to establish a sustainable competitive advantage in digital gaming, reflecting Penn’s adaptive strategy to thrive in a dynamically changing industry.

Performance Metrics and Investor Sentiment

Investor sentiment regarding Penn Entertainment is shaped significantly by its performance metrics. The combination of reported revenues, market share growth, and strategic initiatives contribute to how investors view the company’s potential. Recent adjustments in adjusted EBITDAR and the narrowing of net losses have brought a sense of cautious optimism among stakeholders, underscoring investor confidence in the company’s trajectory amid challenging conditions.

Furthermore, as Penn Entertainment navigates through its operational landscape, the engagement with shareholders will remain crucial. Clear communication of strategic objectives and financial performance will be necessary to maintain investor trust and support future capital initiatives. As the company aims for profitability and growth, monitoring these performance metrics will be pivotal in shaping investor expectations.

Frequently Asked Questions

What were the key takeaways from the Penn Entertainment Q1 report for revenue?

Penn Entertainment reported a first-quarter revenue of $1.4 billion, falling short of Wall Street’s expectations of $1.7 billion. Disruptions from winter weather and underwhelming sports betting results contributed to this shortfall, although the company highlighted robust growth in its digital casino revenue driven by ESPN BET.

How did weather conditions affect Penn Entertainment’s first-quarter revenue?

Weather events in January and February negatively impacted Penn Entertainment’s adjusted EBITDAR by at least $10 million during the first quarter, which contributed to their overall revenue falling below analysts’ forecasts.

What is the growth outlook for ESPN BET according to Penn’s Q1 report?

ESPN BET holds a modest 2.7% market share in the sports betting market as of March, ranking sixth nationally. Despite this, the platform is positioned as a key growth driver for Penn’s online casino operations, which are currently active in New Jersey and Ontario.

What were the results for Penn’s interactive gaming segment in Q1 2023?

In the first quarter, Penn Entertainment’s interactive gaming segment generated $290.1 million in revenue but reported an adjusted EBITDA loss of $89 million. This loss represents an improvement of $106 million year-over-year, indicating a positive trend in their digital casino revenue.

What future strategies does Penn Entertainment have for improving its sports betting market share?

Penn Entertainment has reaffirmed its long-term goal of achieving a 20% sports betting market share by 2027. This ambitious target will be supported by innovations such as integrating fantasy sports with betting options and leveraging upcoming streaming opportunities with Disney’s ESPN.

What effect did the Mint Club rewards program have on ESPN BET users?

The Mint Club loyalty program launched by Penn for ESPN BET users has shown promising results, with members logging in 2.7 times more frequently and betting 60% more each week compared to general users, which suggests a positive impact on user engagement and revenue.

What are Penn Entertainment’s projections for digital revenue in Q2 2023?

For the second quarter of 2023, Penn Entertainment projects digital revenue to range between $280 million and $320 million, along with an anticipated adjusted EBITDA loss of $50 million to $70 million.

Is Penn Entertainment addressing shareholder concerns amidst its Q1 results?

Yes, Penn Entertainment has acknowledged ongoing tensions with hedge fund HG Vora Capital, which recently filed a lawsuit regarding board seat reductions. This comes amid discussions about the company’s financial performance and shareholder democracy.

| Key Metrics | Q1 2023 Performance | Comparative Metrics |

|---|---|---|

| First-Quarter Revenue | $1.4 billion | Wall Street Expectation: $1.7 billion (miss) |

| Adjusted EBITDAR | $457 million | Better than anticipated loss of $0.29 per share |

| Net Loss Per Share | $0.25 | Improved from a loss of $0.79 a year ago |

| Interactive Segment Revenue | $290.1 million | Adjusted EBITDA loss of $89 million (improved from previous year) |

| Market Share (ESPN BET) | 2.7% | Ranked 6th nationally |

Summary

Penn Entertainment first-quarter revenue of $1.4 billion fell short of expectations due to several adverse factors, yet the company shows potential for growth in its digital segment. Enhanced performance in its interactive division indicates a step forward, with new strategies and technologies driving future profitability. As Penn continues to adapt and integrate with market trends, the company aims for significant improvements in subsequent quarters.